“10 Must-Know Tips for First-Time Homebuyers in India.”

Some decisions in life change our lifestyle in many ways, and buying a home is one of those decisions. Especially when you are purchasing a home for the first time, everything can feel new. You need to consider your budget, secure a loan, understand the documentation, and choose the right property.

Many people, lacking proper knowledge and information, often make hasty decisions and later regret the negative consequences. However, if you equip yourself with the right knowledge and information, the process of buying the right property will be safe and secure.

In this blog, we explain the 10 tips every buyer should follow to turn their first home into their dream home.

- Decide Your Budget First Before You Search: It’s essential to know the total cost of the home you plan to buy. Once you have a budget, you can explore homes according to your criteria and break down the cost into EMIs, down payments, and other charges.

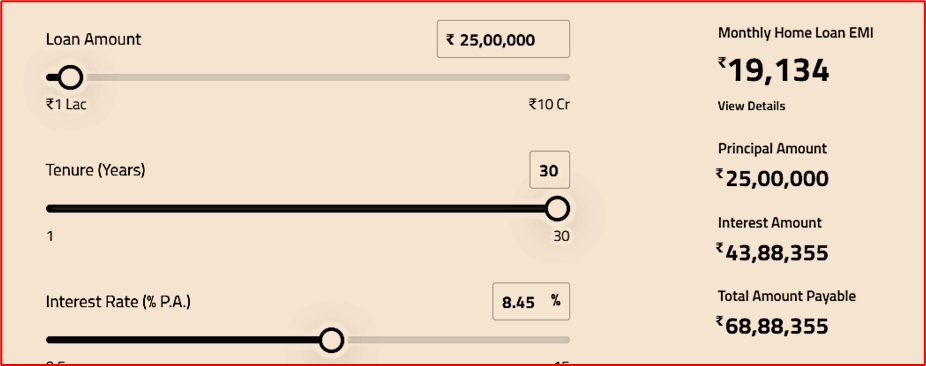

Calculate Home Loan EMI: Determine your budget and calculate the monthly EMI. Ideally, the monthly EMI should not exceed 30-40% of your monthly income. Use EMI calculators available online to help you plan.

Know the Down Payments and Hidden Charges: Typically, down payments range from 10-25% of the total property cost, depending on the builders and developers. Address hidden charges such as stamp duty, registration costs, club house fees, Preferential Location Charges (PLC), Advance Maintenance Deposits, Electricity & Water Connection Charges, Floor Rise Charges, Parking Charges (Covered / Uncovered), Legal & Documentation Charges, Society Membership Charges, and Infrastructure Development Charges or External Development Charges.

Pro Tips: Before booking your home, ask the builder if GST, registration, amenities, and other charges are included in the quoted cost. Always request a written quotation.

2. Check Home Loan Eligibility and Get Ensured: If you’re buying a home through bank financing, follow these steps:

- Aim for a Cibil Score upto 750 or above for easy loan approval and favorable interest rates.

- If your score is below 650, consider approaching a Non-Banking Financial Company (NBFC) which may offer loans with a lower score.

- If you struggle to meet loan criteria, having a guarantor with a solid financial background can help secure the loan.

- Bank vs NBFC : Banks typically offer loans at lower interest rates but have stricter approval processes, while NBFCs might provide quicker processing but often at higher rates.

3. Choose the Right Location and Property: Selecting the right location and property type is crucial for turning your dream home into reality.

- Flat or Plot? New or Resale?: Understand the differences between buying a flat and a plot. A flat options allows you to move in right away, while buying a plot means you’ll need to build a home. New projects often present better investment opportunities than resale properties.

- Local Facilities and Future Value: Research nearby amenities like schools, markets, and hospitals, as these will enhance your property’s future value.

4. Select RERA Registered Project: Prioritize projects registered with RERA (Real Estate Regulatory Authority) to ensure transparency and reliability.

- Benefits of RERA: Verifies legal approval of the property, assures timely project delivery, standardizes carpet area, Advance Payment Limit, Quality Assurance, Grievance Redressal, Escrow Account Protection, and Penalty on Builder for Non – Compliance.

- State Specific Checks: Ensure to check project information relevant to your state. Such as

For Uttar Pradesh: https://www.up-rera.in

For Haryana State: https://haryanarera.gov.in

5. Investigate All Legal Documents: Make sure to verify all property documents either independently or through a consultant.

- Checklist of Important Documents: Include the Title Deed: Ensure the clear ownership, Encumbrance Certificate (EC) – If you buy Resale Property, Occupancy Certificate (OC) – Must have, Completion Certificate (CC) – It Certify the construction according to Approved Plan, Non Objection Certificate (NOC) – like Fire, Environmental, Water, Electricity Departments. Required in large projects, Property Tax Receipt ( For Resale Property), Sale Deed, Mutation / Khata Certificate (For Plot Type Property), Building Plan Approval, and RERA Registered Certificate.

Pro Tips: If purchasing from a builder, maintain records of Builder Buyer Agreement / Allotment Letter, Payment Receipts.

6. Site Visit and Check Construction Quality: Always visit the project site to inspect the quality of wall finishing, fittings, Water / Electricity, Ventilation, Lift and CCTV etc. Under Construction Project may be cost wise profitable and will be wait till completion of Project.

7. Dealing On Price & Payment Plan: Negotiate all aspects like Base Selling Price, PLC, Car Parking, GST Waiver etc. based on your situations. Understand the available offers & Schemes reality, terms & conditions of plan clearly.

8. Carefully Read the Agreement to Sell and Sign: You should mainly focus on key clauses such as Delay Penalties, Cancellation Policies, Handover Dates, and Responsibilities of Builder, process of Registration, and Stamp Duty Payment.

9. Stamp Duty & Complete the Registration: Stamp Duty rates can very by state wise, so check the applicable rates of your locations. Ensure all required documents are prepared for the Registration of your property and documents, will be attached like ID proof, sale deed, Pan Card copy, & Photographs for the registration work.

10. Check Before Taking Possession

- Before taking the possession of your new home, verify that you receive all essential documents, such as the NOC, occupancy Certificate, Full Payment Statement, Maintenance Paper by builder / owner.

- Without taking OC, may be risky for living legally.

Conclusion: Buying a home is a significant step, and it is essential to approach the process with careful consideration and proper knowledge. Gather information, seek professional advice, and remain patient while making your decision. Pay attention to all factors related to location, property type, legal frameworks, and your long-term interests.

Remember To:

- Do with proper research.

- Seek professional advice.

- Negotiate with Smartly and Patiently.

- Stay Informed on Market Trends.

For many, buying their first home in India is a dream that signifies a new chapter in life, prosperity, and growth.

One Comment